North America Income Tax Calculator (2025)

Understanding Tax Brackets (Canada & United States)

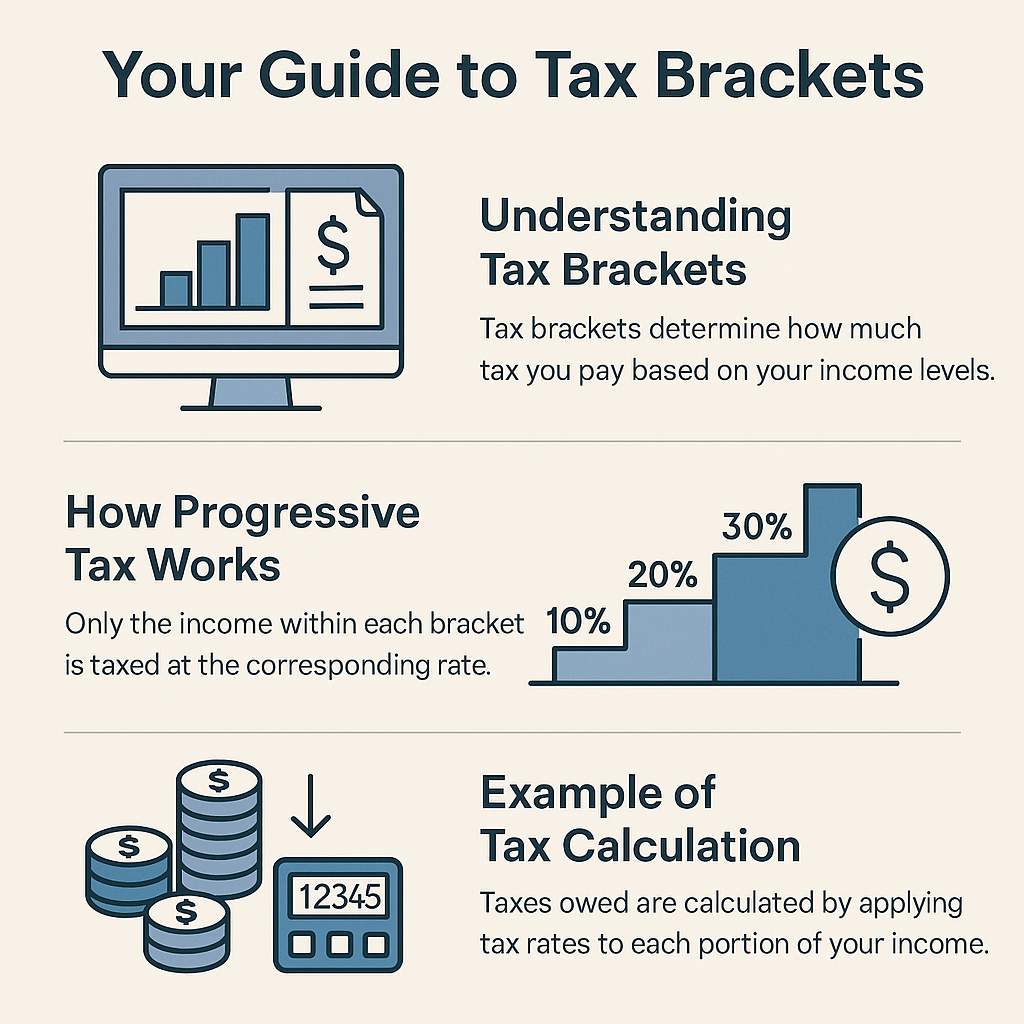

Tax brackets determine how much tax you pay depending on your income level. This guide explains how tax brackets work, why they matter, and how your taxable income is calculated in Canada and the U.S.

1. What Are Tax Brackets?

Tax brackets divide your income into sections. Each section is taxed at a specific rate. As your income increases, only the portion that falls within a higher bracket is taxed at the higher rate.

2. How Progressive Taxation Works

Canada and the United States use a progressive tax system. This means:

- You do not pay your top bracket rate on all your income.

- Each slice of income is taxed at its own bracket's rate.

- Your “marginal tax rate” is the rate on your last dollar earned.

3. Example of Tax Calculation

Here is a simplified example assuming 3 brackets:

- 0–$50,000 → 10%

- $50,001–$100,000 → 20%

- $100,001+ → 30%

If you earn $120,000:

- The first $50,000 is taxed at 10%

- The next $50,000 is taxed at 20%

- The final $20,000 is taxed at 30%

Your *effective tax rate* is lower because not all your income is taxed equally.

4. Why Tax Brackets Matter

Understanding tax brackets helps you:

- Estimate your take-home pay

- Optimize RRSP / 401(k) contributions

- Plan raises or job changes

- Evaluate deductions and tax credits

5. Federal vs. Provincial / State Tax Brackets

Both countries have:

- Federal brackets that apply to everyone nationwide

- Provincial or state brackets that vary by region

Your total tax is the sum of federal + provincial/state tax.